Contents:

Technicians also look for relationships between price/volume indices and market indicators. Examples include the moving average, relative strength index and MACD. Other avenues of study include correlations between changes in Options and put/call ratios with price.

It’s literally like being over your shoulder watching you analyse the chart. Repetition of key concepts was important as the examples shown clarified what you wanted to explain. The beauty of it all is, I can go back to the recordings targeting any areas of weakness I’ve identified. Zig Zag – This chart overlay that shows filtered price movements that are greater than a given percentage. Moving average– an average over a window of time before and after a given time point that is repeated at each time point in the given chart.

Just right for a newbie investor who wants to learn the basics and not so basics of technical analysis and trading. “Profit Chaser Talk” is a daily financial newsletter focused on the Indian Stock Market. It offers comprehensive news and analysis on Indian stocks listed on the Indian Stock Exchange, empowering readers with the information they need to make well-informed trading choices and optimize their returns. Everything you need to learn to go from beginner to advanced level in technical analysis. For $1,000 you get lifetime access to the course content, which is refreshed regularly. While there is no coaching, mentoring, or chat rooms for interactive learning, this extensive, self-paced course can elevate you to a level where you can get more out of a paid trading program.

Technical Analysis 1-on-1 Mentorship For Day Traders, Beginner’s … – Digital Journal

Technical Analysis 1-on-1 Mentorship For Day Traders, Beginner’s ….

Posted: Thu, 09 Mar 2023 05:23:01 GMT [source]

You can then follow up the beginning course with the https://trading-market.org/ Analysis Masterclass part two for another $17.99. Part two helps you to maximize your knowledge to become a more efficient trader. For example, to learn more about candlestick patterns, We recommend you use an android app called JCP. The app gives you all the education and tests you need to become an excellent candlesticks trader. Start to learn one of the most popular analysis techniques used to find opportunities in the markets.

Technical Analysis: Top Down vs. Bottom Up

While traditional backtesting was done by hand, this was usually only performed on human-selected stocks, and was thus prone to prior knowledge in stock selection. With the advent of computers, backtesting can be performed on entire exchanges over decades of historic data in very short amounts of time. Technical analysts also widely use market indicators of many sorts, some of which are mathematical transformations of price, often including up and down volume, advance/decline data and other inputs. These indicators are used to help assess whether an asset is trending, and if it is, the probability of its direction and of continuation.

How one Florida woman broke into the male-dominated world of … – Tampa Bay Times

How one Florida woman broke into the male-dominated world of ….

Posted: Wed, 29 Mar 2023 10:30:31 GMT [source]

In this article, We will focus on technical analysis and explain the best way to become a master. Be patient enough because most times, despite excellent analysis, your trades might fall short. Charts are a tool every technical trader needs to master – lets bring you up to speed.

Breadth indicators

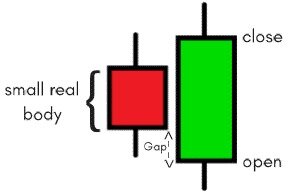

Average directional index– a widely used indicator of trend strength. Candlestick chart– Of Japanese origin and similar to OHLC, candlesticks widen and fill the interval between the open and close prices to emphasize the open/close relationship. In the West, often black or red candle bodies represent a close lower than the open, while white, green or blue candles represent a close higher than the open price.

This is a tool for identifying market price fluctuations, which, thanks to flexible settings, can be used in a trending market and during consolidation. CCI shows the current change in the ticker rate relative to its average indicator change. This indicator can be used to identify divergences and convergences, entry points or as a filter for signals from other instruments. An area chart is visually easier to perceive than a line chart since local lows and highs can be easily identified. The volume chart can be of particular interest to scalpers who like to use charts with details up to the price tick.

Market action discounts everything

While it’s not an exact science, successful traders who master technical analysis get it right much more often than they get it wrong. In finance, technical analysis is an analysis methodology for analysing and forecasting the direction of prices through the study of past market data, primarily price and volume. Behavioral economics and quantitative analysis use many of the same tools of technical analysis, which, being an aspect of active management, stands in contradiction to much of modern portfolio theory. The basic technique is to determine the current direction of price movement, that is, a trend. Determining key levels and analyzing trading volumes will help you navigate the market. Then you can conduct chart and candlestick technical analysis, that is, study the trading chart in search of possible patterns.

- Relative Vigor Index – oscillator measures the conviction of a recent price action and the likelihood that it will continue.

- In other words, when you have to sell if the trend indicators are in line with it.

- Everything you need to learn to go from beginner to advanced level in technical analysis.

- Applying Kahneman and Tversky’s prospect theory to price movements, Paul V. Azzopardi provided a possible explanation why fear makes prices fall sharply while greed pushes up prices gradually.

- Start earning some extra money and building your wealth in the stock market.

The Bollinger Bands indicator is able to determine the current position of the price relative to its average trading range. It is used to identify signals for a market reversal and continuation of the current trend. At the same time, it is more difficult to build trend lines, support and resistance levels and use other graphical tools on it. The chart above shows that they simply merge with the color markings on the chart and are difficult to read. By the principle of construction, area charts are similar to line charts.

Technical Analysis of Stock Market for Beginners

Lagging indicators are more accurate, but less effective, as they give a signal after the fact. On the other hand, leading indicators give signals with a time margin, but with a significant proportion of false ones. When creating a trading strategy, each trader faces the problem of reducing the lag and maintaining the quality of signals within acceptable limits. TA is based on the analysis of the retrospective price movement and its interpretation for the future. The trader makes decisions based on patterns of behavior in the past and assumes that they will repeat in the future.

Profitable stocks and crypto trading involves a lot of know how and experience in Technical Analysis. However, the fundamentals behind technical analysis techniques, tools, resources and effective strategies can be complex to grasp, understand and even expensive to access. Using data analytics of popular trading strategies and indicators, to identify best trading actions based solely on the price action. Because momentum indicators generally only signal strong or weak price movement, but not trend direction, they are often combined with other technical analysis indicators as part of an overall trading strategy. Because momentum indicators measure trend strength, they can serve as early warning signals that a trend is coming to an end.

- The main drawback of such a chart is that it does not show price volatility over the selected time period.

- The advantage of some of the more expensive courses is not only the expert instruction, but it’s also the access to trading tools and resources that can further advance your learning.

- TOY’s 5-day moving average is 36.67, which suggests TOY is a Sell.

- We deals in various categories like novels, books, apparles, home decor & furnishing, electronics and many more.

- Not a single technique and tool of technical analysis provides sufficient forecast accuracy for effective trading decisions.

By mastering profitable trading strategies, you’ll no longer rely on others or lose money every day. Consider this investment as a stepping stone to daily profitable trades and long-term wealth creation. What differentiates the great courses is expert instruction and access to tools and resources to accelerate the learning curve.

Comparison with quantitative analysis

It offers ten free courses and an ebook with free, seven-day access to its trading room and other valuable trading tools, making it our pick as the best technical analysis course for learning while doing. Trading with technical analysis requires a lot of study and practice. In addition to studying patterns and indicators, you need to master behavioral economics and risk management. The more knowledge and practice you have, the more confidence you gain. The best way to get there is with a quality technical analysis trading course.

Portfolio managers use technical analysis alongside fundamental analysis to identify investment opportunities for their clients. Generally, any investor who used technical analysis is trying to maximize their return on investment. Unlike fundamental analysis, technical analysis does not take into account external fundamental factors that influence the value of a stock, such as competition or demand for a company’s products. In their forecasts, technical analysts use tools to search for patterns on charts and perform arithmetic calculations. It is believed that the price of an asset has already included all the factors affecting the position of the issuing company. Technical analysis means to take trading and investment decisions based on chart analysis of particular instrument.

OBV (On-Balance Volume) is an indicator that is synchronous with the price, and sometimes even ahead of it. It reflects price fluctuations based on changes in market activity over a specified period of time. ADX is used to determine the momentum or strength of a directional movement. High values indicate a strong trend, regardless of its direction.

Note that the sequence of lower lows and lower highs did not begin until August. Then AOL makes a low master technical analysis that does not pierce the relative low set earlier in the month. Later in the same month, the stock makes a relative high equal to the most recent relative high.