Contents:

Your Guide to Starting a Business The tools and resources you need to get your new business idea off the ground. Where you did you enter class information – in 1 instance for the entire invoice or on a per line invoice? For the per line, you’d need to modify the standard invoice form. That’s supported in QB 2014, and it’s been a while since we’ve had to open QB 2011, so perhaps its not supported. If it’s not supported, then you’d be better off to void the transfer, and use a general journal entry, which does support classes.

- https://maximarkets.world/wp-content/uploads/2020/08/forex_education.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/logo-1.png

- https://maximarkets.world/wp-content/uploads/2019/03/Platform-maximarkets-1.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/trading_instruments.jpg

- https://maximarkets.world/wp-content/uploads/2019/03/MetaTrader4_maximarkets.jpg

The main advantage of class tracking is that categorizing expenses is easier because there is more control over it. Since class tracking can be used in most transactions, it makes it easier for you to generate reports to compare the balances across multiple classes, departments, or locations. To do so, see how tofilter, sort, or total reports by class. Use classes to track your transactions by departments, product lines, or any other meaningful segments in your business.

There are other tools in QB for other tracking commonly used by construction firms. Class tracking would not be used for construction job costing. For job costing, you’d set up items for the different products/services that go into a construction project (e. g., framing materials), and transactions would flow through those items. By an Account Quickreport, do you mean you opened the Account Listing, right clicked on an account, and chose the last item on the context menu, which is to produce a Quickreport?

How To Turn On Class Tracking In QuickBooks

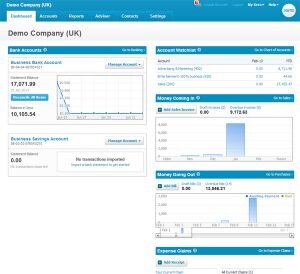

The class tracking option is now available on your company profile. The right QuickBooks Online plan depends on the size of your business and the features you need. For example, Self-Employed is best for freelancers or solopreneurs, while Simple Start is ideal for small businesses wanting to track assets and liabilities. Essentials is preferable if you need to track unpaid bills, while Plus is great if you require inventory and project management. All QuickBooks Online plans have basic mobile accounting features, such as the ability to create and send invoices. However, higher tiered plans have additional functionality, like the ability to enter bill payments and view reports.

Quickbooks Pro vs Premier – Forbes Advisor – Forbes

Quickbooks Pro vs Premier – Forbes Advisor.

Posted: Wed, 04 Jan 2023 08:00:00 GMT [source]

Click the arrow next to the “Class” button at the bottom of the page. Ease of use consists of customer support, support network of bookkeepers, and user reviews. QuickBooks Online is our overall best small business accounting software. To help narrow down the best plan for your business, answer a few short questions below. This will offer you a customized recommendation based on the responses you give. Afterward, continue reading our article for a more detailed comparison of the five QuickBooks Online versions.

QuickBooks Online Plan Comparison Frequently Asked Questions (FAQs)

You can use the Direct Connect Option by enrolling for the Direct Connect service which will allow you access to the small business online banking option at bankofamerica.com. This feature allows you to share bills, payments, information, and much more. The actions listed below must be followed in order to enable class tracking in your QuickBooks. Although it takes some time to Set up, Class Tracking is worthwhile in the long term. You receive a thorough breakdown of your business expenses and can monitor how your money is being used.

Therefore, if you want to begin adding and assigning classes inside your QuickBooks account, you must switch it on. Almost all of the most typical transactions can be classified. And that’s beneficial since it makes it simpler to build reports by filtering by numerous classes, departments, or places.

Your are correct in saying not all expenses are connected to customers. What if use classes for the locations and for the brands create the same subclass for each of the locations. Create class called “location1”, “location2”, “location3” and for each of these locations create brands with the same subclass “Red”, “Green”, “Blue”, “Yellow”.

© 2023 Intuit Inc. All rights reserved

There are several uses for the https://bookkeeping-reviews.com/es and the sub-classes. Some company owners use classes to separate income and expenses by place, category, job type, source, etc. Dancing Numbers is SaaS-based software that is easy to integrate with any QuickBooks account. With the help of this software, you can import, export, as well as erase lists and transactions from the Company files. Also, you can simplify and automate the process using Dancing Numbers which will help in saving time and increasing efficiency and productivity.

We even consider it the best for tracking freelance income and filing tax returns in our guide to the best accounting software for freelancers. Check out our review of QuickBooks Online Self-Employed to see what it can do for freelancers and solopreneurs. A user can select to assign classes one time in a complete transaction or he can assign line-by-line, like for every sales item line.

QuickBooks Online Comparison: Pricing & Features

Similar to office location class tracking, you will be able to determine which departments are generating the most revenue. You may not want to track the profit for every individual residential project, so you might classify all residential projects as one “client,” with specific jobs set up as contracts. Under this system, you can still issue an invoice for each individual residential job, but you can also evaluate how well you are doing on residential work at an overall level.

Once class tracking in QuickBooks is turned on, it can help you make informed decisions to improve the efficiency and profitability of your business. As you can see, nearly all of the most common transactions can be assigned a class. And that’s a good thing because it makes it easier to filter by multiple classes, departments, or locations to create reports. With QuickBooks Essentials, you can track billable time by job and assign it to a specific customer—something you can’t achieve with Simple Start. Once you’ve recorded your billable time, you can add them to your invoice and then send it to your client.

This is a bit inconvenient since even solopreneurs or freelancers have bills that need to be paid. However, if you only need to record expenses as you pay them, then Simple Start might be enough. Creating a bank account in QB in a currency other than your home currency involves enabling the multi-currency feature, creating the bank account, and choosing the appropriate currency for it. If you have more questions on multi-currency, have a look at our articles on that topic and please post them there. This will provide you the opportunity to either focus on more profitable jobs and clients or allow you to pinpoint jobs and clients that need to better managed or eliminated. You can determine if you made a gross profit or incurred a loss at the job, client or set of clients level.

What’s New The latest product innovations and business insights from QuickBooks. E-commerce How to start and run a successful e-commerce business. Employees Everything you need to know about managing and retaining employees. Small Business Stories Celebrating the stories and successes of real small business owners. Payments Everything you need to start accepting payments for your business.

Such as a crop farm near Dallas, a poultry farm in Houston, and a different piece of land for raising cattle in San Antonio. Want to learn about the features of QuickBooks Online in your local language? Check out our new Language Support Options help article. Find the class you want to restore, then select Make active.

- https://maximarkets.world/wp-content/uploads/2021/06/platform-maximarkets-4.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/forex_trader.jpg

- https://maximarkets.world/wp-content/uploads/2021/06/platform-maximarkets-all.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/ebook.jpg

- https://maximarkets.world/wp-content/uploads/2019/03/Platform-maximarkets-2.jpg

In order to calculate the total cost of a project, you will need to apply the minimum requirements for working as an independent contractor. Indirect costs are expenses that do not relate to one specific contract but support the projects or business as a whole. Indirect costs need to be allocated against all contracts on a consistent and logical basis. Allocations can be tailored to your specific industry and the type of job.

FreshBooks vs. QuickBooks Comparison – Forbes Advisor – Forbes

FreshBooks vs. QuickBooks Comparison – Forbes Advisor.

Posted: Sat, 31 Dec 2022 08:00:00 GMT [source]

By eliminating the one category that’s fallen behind, your business as a whole could profit even more. Select Advanced, then select the Categories section to edit. Select Advancedthen select the Categoriessection to edit. Here’s how to tag a class to each row or item in any transaction. From big jobs to small tasks, we’ve got your business covered. The latest product innovations and business insights from QuickBooks.

Accounting transactions are no longer entered manually as they once were. Create your budget and attach actual data in only a few clicks. Another wonderful QuickBooks tip is that you may instruct the software to notify you whenever a transaction is created without a class. Your forms will now have a class field or column that you may use to categorize transactions. To add a sub-class, select Is a sub-class and select the main class. For example, the coffee shop with three locations may run radio ads featuring all three locations.